Industry Analysis

Market Scenario

India is not only the largest sugar consumer across globe but also the second largest sugar producer. About 14% of the total global production is contributed by India. Sugar industry in India is highly unorganized and plays a crucial role in supporting the domestic agro-industry.

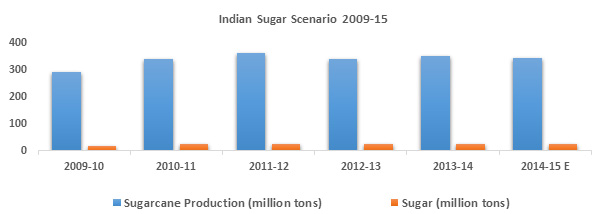

Growing at compounded annual growth rate (CAGR) of 3.24% during the period 2009-15, the domestic sugarcane production is estimated to increase to about 342.78 million tons in 2014-15 from 292 million tons in 2009-10. Domestic sugar production is estimated to reach 25.04 million tons in 2014-15 from 18.8 million tons in 2009-10, indicating a CAGR of 5.90% from 2009-15.

Source : Department of Agriculture and Cooperation, Ministry of Agriculture, Govt. of India.

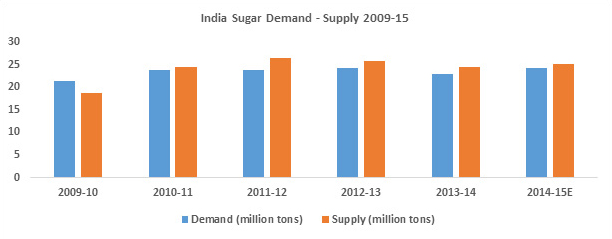

The number of operating factories in a particular year eventually indicates the cyclical nature of sugar industry. The number of domestic operating factories during 2013-14 declined to 509 from 529 in 2011-12 indicating surplus sugar during 2013-14. The domestic requirement of sugar is largely met by indigenous production. While production grew at a CAGR of 5.90% during 2009-15, the domestic consumption is estimated to grow at a CAGR of 1.82% during the same period.

Source: Department of Commerce, Govt. of India

From the trade statistics, it is comprehended that apart from being a producer and consumer of sugar, India also holds a commendable position in export of sugar. The import of sugar is observed to follow a declining pattern because of hiked import duty to safeguard domestic sugar industry.

Source: Department of Commerce, Govt. of India

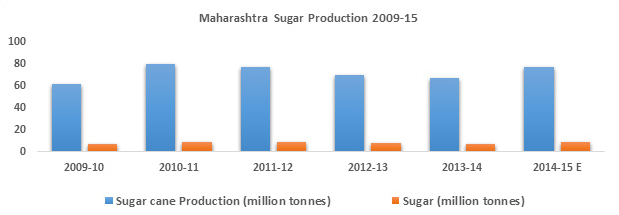

Sugarcane is an important raw material in sugar production, hence all sugar companies have been set up in the vicinity of sugarcane growing regions. Dominant sugarcane growing states are Uttar Pradesh, Maharashtra, Karnataka, Gujarat, Tamil Nadu and Andhra Pradesh. These states account to about 85% of the total domestic sugar production. Maharashtra leads the domestic sugar production with a share of about 35% during the year 2014-15. Though Maharashtra is the second largest state in sugarcane production, it still leads the domestic sugar production largely because of –

- High recovery rate (average 11.41%);

- Highest number of operating mills;

- Deviation of sugarcane in gur and khandsari production in Uttar Pradesh, the largest sugarcane producing state.

Source: Directorate of Economics & Statistics, Govt. of India

With about 165 operational factories and growing at a CAGR of 2.47% during 2009-15, sugar production in Maharashtra, increased to about 8.8 million tons in 2014-15 from 7.1 million tons in 2009-10.

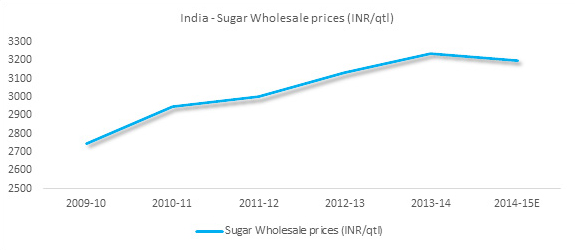

Domestic sugar prices is estimated to have grown at a CAGR of about 3.08% during 2009-15. Sugar pricing has seen a steady increasing behavior because it is regulated by government. As sugar is a sensitive consumer commodity, the movement of sugar pricing is done in a predetermined manner by monitoring domestic production and regulating import/export duties.

Source: Directorate of Economics & Statistics, Govt. of India

Going through the market description, though cyclical in nature the future of sugar industry appears promising. The potential of sugar, its products and by-products are still to be fully harnessed. Indian sugar industry is pre-dominantly at the bottom of the value chain, hence the prospects of moving up in the value chain are optimistic in order to meet the untapped potential.